Things are a bit mad at the moment and there is a lot of confusion and change happening, so we wanted to post information to help clarify some of the changes the government has made regarding accessing your super and pensions due to the COVID-19 outbreak.

Please Note: As these changes are still going through parliament, there may be some slight changes to these measures before they are formally introduced. It is important to ensure you are re-checking and reviewing the details before making any decisions. This is not financial advice, it is factual information. You should contact your financial adviser to determine if accessing super is the right thing for you to do.

Early Access to Superannuation

Eligibility

To apply for early release you must satisfy any one or more of the following requirements:

- you are unemployed; or

- you are eligible to receive a job seeker payment, youth allowance for jobseekers, parenting payment (which includes the single and partnered payments), special benefit or farm household allowance; or

- on or after 1 January 2020:

- you were made redundant; or

- your working hours were reduced by 20 per cent or more; or

- if you are a sole trader — your business was suspended or there was a reduction in your turnover of 20 per cent or more.

People accessing their superannuation will not need to pay tax on amounts released and the money they withdraw will not affect Centrelink or Veterans’ Affairs payments.

For further details and information on how you can apply for this release, please refer to this Fact Sheet:

https://treasury.gov.au/sites/default/files/2020-03/Fact_sheet-Early_Access_to_Super.pdf

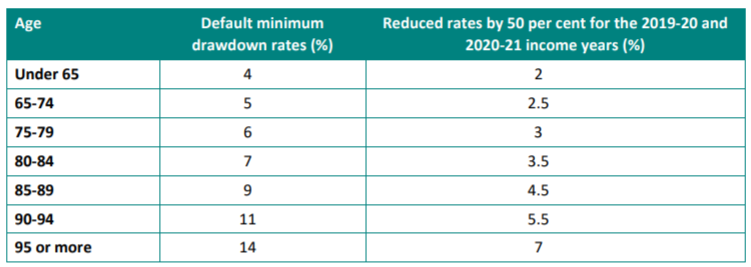

Reduced Pension Minimum

If you are currently drawing a pension from your SMSF, from now until the end of the 2020 / 2021 financial year you will be able to withdraw a reduced minimum, in order to maintain funds in your pension account:

For further information on this change, please refer to this Fact Sheet: https://treasury.gov.au/sites/default/files/2020-03/Fact_sheet-Providing_support_for_retirees_to_manage_market_volatility.pdf

This information is constantly being updated, but we will do our best to keep you up to date as much as possible. As always, if you have any questions or concerns, please contact us or your financial adviser.